Process of importing goods in the form of official quota:

Receive notification of goods arrival, check documents

Customs declaration for goods

Pay tax and get delivery order

Print the goods delivery note, liquidate and pick up the goods

Step 1: Receive notification of goods arrival, check documents

The set of documents for carrying out procedures includes:

Sale contract: Commercial contract

Commercial invoice: Commercial invoice

Packing list: A detailed list of goods

Bill of Lading: Bill of lading

C/O: Certificate of origin

Other documents – if any

Step 2: Customs declaration for goods

Businesses need to declare customs for goods on Ecus5/Vnaccs software. After successful declaration, the system will automatically classify:

Green channel: exemption from document inspection and physical inspection of goods (number on declaration: number 1)

Yellow channel: check documents and exempt from physical inspection of goods (number on declaration: number 2)

Red channel: check documents and physically check goods (number on declaration: number 3)

Step 3: Pay tax and get delivery order

After having the channeling declaration, proceed with inspection and pay tax for the shipment. There are 3 tax payment methods, including electronic payment, bank payment or treasury payment. At the same time, execute the delivery order:

When receiving a delivery order, you need to prepare the following documents:

- Letter of introduction from the receiving company on the arrival notice.

- Bill of lading.

- Arrival notification.

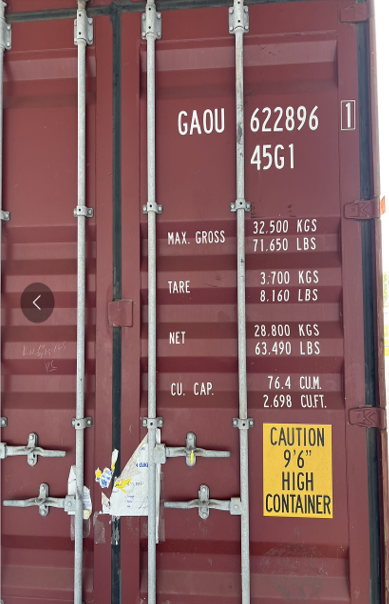

When taking orders, please note that with container goods, the following accompanying documents are required:

- Make paper to borrow Container.

- Empty container certificate (applied when taking containers back to the warehouse for withdrawal).

- Delivery order deadline: check if the order is still due or not.

- Get Bill.

Step 4: Print the goods delivery note, liquidate and pick up the goods

After the declaration is cleared, print the goods delivery note and liquidate to get the goods.

Headquarters:

- Hanoi Warehouse Address: Hanoi Tai Tu Industrial Park, 386 D. Nguyen Van Linh, Thach Ban, Long Bien, Hanoi

- Block B2-2 Factory Area B2 Lot A Street N5B Le Minh Xuan 3 Industrial Park Binh Chanh District Ho Chi Minh

- Road No. 15, Tan Duc Industrial Park, Huu Thanh Commune, Duc Hoa District, Long An

About Andalog

Mission Vision

Core values

Leader

Achievement milestone

Support

FAQ

Terms of use

Privacy Policy

Contact

API Document

Service policy

Disputes and Claims

Delivery Procedures

Liabilities of Parties

Prohibited Goods

Contact

Website: andalogistics.vn

SĐT: 0911.061.999

Hotline: 0978.919.819